Budgeting 101

By: Oliver Felisilda, RBC On-Campus Assistant Branch Manager & Advisor

Budgeting 101: How to Create a Budget

As a student, you likely have experienced many unexpected changes as a result of the current COVID-19 crisis. You’re doing a great job at adapting to the changes and forming new habits. Now, more than ever, is also the time to make sure that you are staying on top of managing your money – making smart financial decisions now will help you prepare for the future.

One of the ways you can do this is to develop the habit of paying attention to what’s happening to your money and where you want it to go. This article aims to help you understand what that means practically through a strategy that you may already be familiar with – budgeting.

All things related to money are very personal and really no two people’s budgets should or would look the same. So, as you are reading this, I recommend that you bring out something that you can use to document your entries. If done right, you’ll find that what you have created can give you a snapshot of your financial situation, how you feel about it, and adjustments you can make to reach your goals.

What is a Budget?

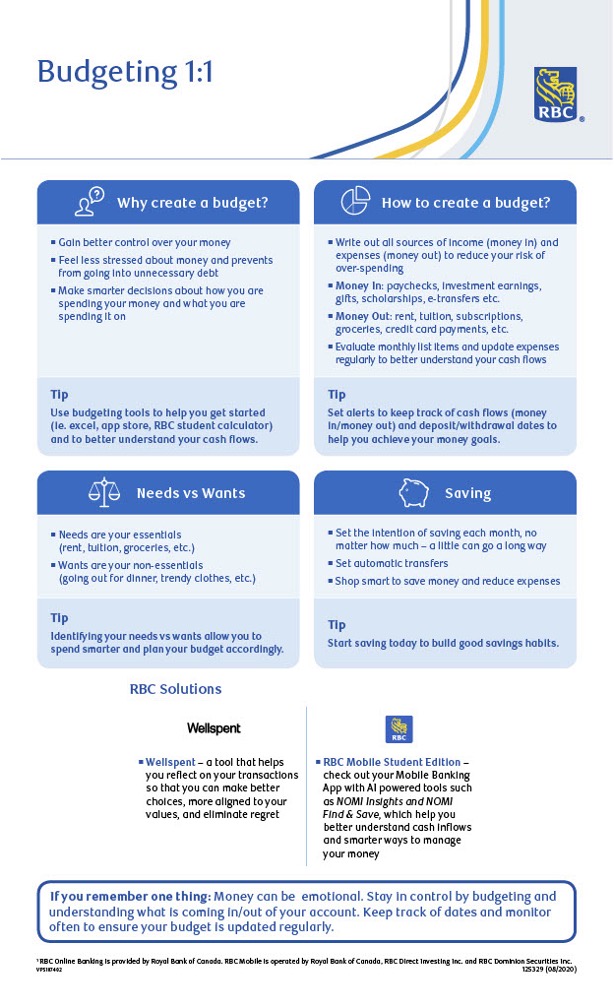

A budget refers to the tool that helps you track and manage your money. While simple, its impact to your peace of mind cannot be overstated.

A budget refers to the tool that helps you track and manage your money. While simple, its impact to your peace of mind cannot be overstated.

It is common to find interruptions in one’s finances. Perhaps a new expense arises unexpectedly or maybe your income declines due to conflicting priorities or losing the time or ability to work. People that budget ultimately have less stress about money, because they have a handle on their financial situation and avoid overspending and managing debt. People that budget also have a better grasp on what they actually need vs. what they want, and can more easily prioritize and make smarter decisions about how to spend their money. Budgeting can really help you make the most of your money and get to your financial goals. Budgeting helps you to stay focused on what really matters in school – not money.

Step One: Income

A budget begins with listing your income. Whether it’s a one-time deposit (OSAP), a regular occurrence (pay check), or an unexpected surprise (birthday money) – money coming in is what you want to consider your ‘income’. The monthly totals of these incomes are going to make up the pool of money that you have access to do be able to spend. On this note, kindly list down all the sources of your income for the month.

So the money that comes into your account doesn’t always stay there – it goes out to pay for things you want, need, and things you think you need but you actually want. To avoid that “empty pockets” feeling, it’s important that you understand your ‘money that goes out’ – or the monthly expenses that you have so you can make sure you have enough income to cover it – and so you also can properly assess and prioritize the expenses that are essential and the ones that are more ‘nice to have’ but not vital.

Step Two: Expenses

So let’s think about what types of expenses that you have. These are the things that you are spending your money on regularly like that quick $2 tap every morning at Tim’s for coffee, or one time bigger ticket items like books you buy at the beginning of every semester, or the rent you pay every month. Take a look and for every item that you spend money on – write the item and the amount the spend column on your budgeting sheet.

Income and expenses are things that you can more or less plan ahead for and expect. Then there are the things that you might want to do with your money, like save for a local getaway, or for an iPhone, or have access to funds that you can spend going out with your friends. You need to be thinking about this stuff so when you start going through the budgeting exercise you’ll be able to see right away what you can afford to actually do.

Step Three: Goals

Take the time now to jot down some things that aren’t accounted for in your expenses or income that you’d like to be able to have money for – record it in the Goals column.

At this point you have a broad list of income, expenses, as well as ‘goals’ for your money. It’s necessary to organize these lists in a way that give you a simple and accurate snapshot of how much money you actually have. There’s so much fluctuation and change in expenses and income in a school year that if you just take an annual overview you won’t actually have a true sense of how much money you can spend each day to stay in control of your finances and feel confident when managing your money, so that you can achieve your goals.

The amount of money moving in and out of your account isn’t the only thing that matters. You also need to be aware of when money is moving in or out – so you can budget to have enough in your account to cover the expense. How often money is moving in or out is also important to make sure that the money you have coming in can actually last the entire school year.

You’re going to want to keep track of your budget on a monthly basis so you can plan for both your immediate needs and future needs.

Shortages: What If I Don’t Have Enough Income?

If your balance is negative it means you that income you’ve stated is not enough to cover the expenses you’ve listed. It also means you don’t have any money to contribute to your goals. First thing you’ll want to look at if you’re in this situation is your expenses by finding ways to trim down. You can do this by identifying the things you absolutely need to survive. In addition, it is possible that there are things that are non-essential and should be treated more like goals. For example, I have Starbucks on my goals section of my budget – it’s a treat for me, if I can afford it. But I can live without it. My rent, however, is an essential expense. I wouldn’t be able to survive if I didn’t pay for the roof over my head. Furthermore, reducing the costs of your expenses can go a long way. So you can try to find ways to shop smarter or save money.

On the flip side, the other thing you can try to do is find ways to get more money. But applying for scholarships, getting a job, or finding ways for your money to make you money are some things you can explore. RBC has some resources for jobs and scholarships, your campus will have resources as well. The government has relief programs to help support students. For some of you, asking your parents may be an option. For others, sitting down with a financial advisor might be helpful in finding other solutions that will help your financial situation.

Budgeting Tips

While everyone’s budget is different, the following tips are useful to everyone.

Primarily, budgets are often more effective with an emergency fund as a part of your goals. Allocating about 1% of your income into this fund that can be used for unplanned expenses as they come up can give you more peace of mind. Secondly, always having some type of savings goal gets you into the habit of setting something up and achieving it while putting your funds aside. Furthermore, if your budget balance is 0, it means you aren’t setting yourself up to either plan ahead or save for a goal. So, always be mindful of how your lifestyle is causing a surplus or a shortage.

It is also worth noting that making a budget doesn’t guarantee that you’ll stick to it. Life happens, sometimes you might go over budget or maybe you’ll find that you’re just tapping too much and in adversely increasing your expenses. If you find yourself in a situation where you aren’t staying in your budget – don’t just give up. Every day is a new opportunity to course correct.

One of the ways you can ensure consistency is by ensuring that the budgeting tool that you use is fit for you. There are many apps, tools, and budgeting calculators online that can give you an updated budget in real time.

In addition, alerts are a great way to get proactive and reactive information about your bank account in real time. You can set up alerts through online or mobile banking to get a text every time you tap, to reminder you about an upcoming bill, to see your balance at the end of every day, or to see your balance if it dips a little too low.

If you’re an RBC customer you get access to something called NOMI insights in mobile banking. This is our artificial intelligence tool that analyzes your account activity to give you insights about where your money is going and smarter ways to manage it.

You can also ask for help from your advisor at your financial institution. Your advisor can offer support to make sure you are using the right account, plan for any upcoming changes to your budget or adjust for unplanned changes, minimize unnecessary fees, and ultimately do what they can to keep you on track to achieving your goals.

For any additional questions or concerns about this article, please let us know! We are happy to help you with your journey so please reach out to Oliver or Bruno at the RDC on campus location near the forum or via email at [email protected] or [email protected].